How the HealthJoy Benefits Wallet Works

Using benefits is notoriously difficult. It seems that no matter how much is shared during Open Enrollment, when it comes to actually remembering,...

Connected Navigation Platform

Guiding to high-value care

Behavioral Health

Foster a mentally healthy workplace

EAP

Supporting holistic wellbeing

Virtual MSK Care

Reimagining musculoskeletal care

Virtual Primary Care

Powered by smart navigation

Surgery Centers of Excellence

Best-in-class surgical outcomes

Virtual Urgent Care

Immediate care, any hour of the day

Chronic Care

A new approach to chronic care

Integrations

Flexible to any strategy

Health financial accounts are an excellent tax-free way to save money on eligible medical, dental, and vision expenses. Health Savings Accounts (HSA), Flexible Spending Accounts (FSA), and Health Reimbursement Arrangement (HRA) accounts offer different advantages, but confusion often keeps us from making the most of our options.

For instance, enrollment in a High-Deductible Health Plan (HDHP) qualifies you to open an HSA. Yet in 2020, one in three eligible adults had not done so, according to a survey published in the Journal of the American Medical Association.

HealthJoy can help eliminate confusion about these accounts and simplify the process of using them throughout the year.

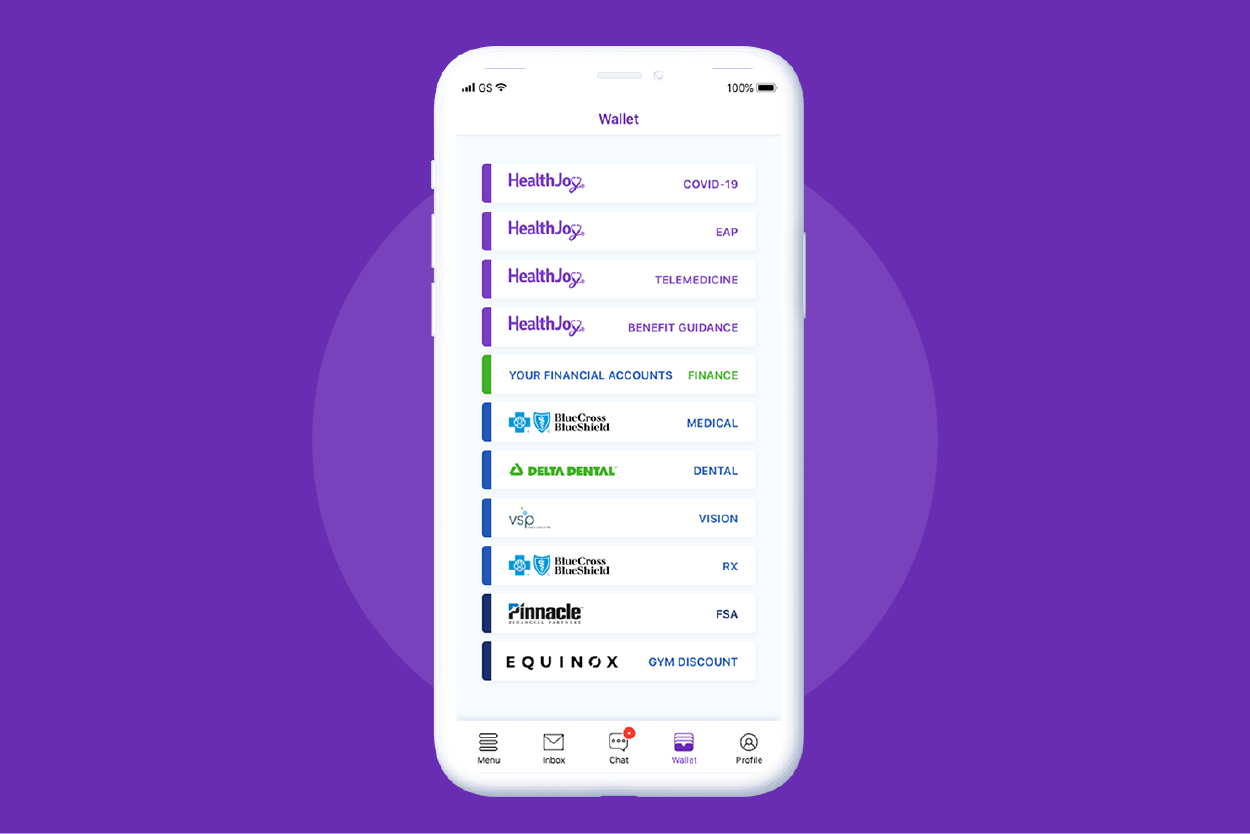

Even if you have an HSA, FSA, or HRA, it can be easy to forget they exist. Maybe you leave your card in your desk drawer at home when you go to pick up your prescription. Perhaps you make an online purchase through ApplePay without thinking or find out that your provider charged your credit card instead of your HSA. Or, you simply haven’t remembered to contribute this year—in the same JAMA Network Open survey , 50% of those with an HSA account hadn’t. HealthJoy helps you see all your benefits, including your financial accounts in your benefits wallet, making it simpler to monitor your savings and put it to use.

You can start by connecting any HSA, FSA, or HRA accounts right from our app. We link with thousands of financial providers, including the most popular ones from HealthEquity, Optum Bank, HSA Bank, and Fidelity. The connection process works through a third-party financial services company called Plaid, which works with clients like American Express, Venmo, and Visa.

Our members aren’t limited to their present employer’s financial accounts but can also connect retirement accounts, older accounts, or even a spouse’s account. Once the accounts are connected, you’ll see financial account details in the wallet. To access them at any time, members just need to tap “My Benefits Wallet” in the menu.

The tax rules surrounding financial savings accounts can be confusing. Contribution limits change each year. Eligibility rules, or the rules governing what you can and cannot spend your health savings funds on, vary by account and might even keep you from taking advantage of your savings at all.

When you’re at the drug store and unsure if sunscreen is covered, where do you turn? When you’re thinking of getting acupuncture, can you plan to spend your HSA funds on the service? Our healthcare concierge team can help.

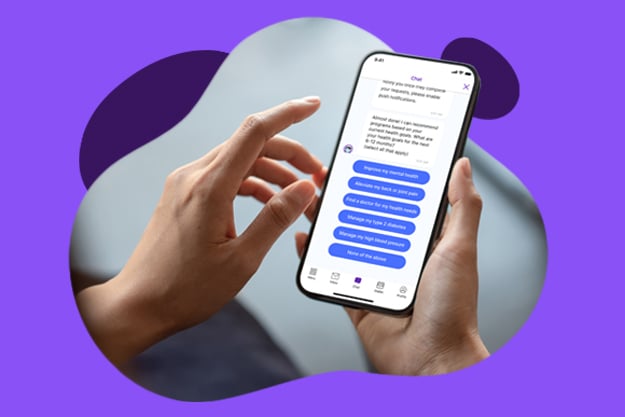

Open the HealthJoy app and tap “Chat” to connect with JOY, our AI assistant, and our team of expert healthcare concierges. They’re always happy to help with the most complicated questions about these accounts, including what’s covered, contribution limits, whether a “use it or lose it” rule applies, and more.

Once you’re aware of your health savings eligibility and maybe even making regular contributions to your account, the next step is to put your funds to use. We simplify this process for members. When they integrate their accounts, HealthJoy can help turn understanding into action.

HealthJoy can help you identify lower-cost prescription alternatives through a free RX Savings Review. We’ll also remind members to pay for medications using their HSA or other eligible accounts.

When HealthJoy performs a provider search, our recommendation will include a reminder to use your financial health accounts for eligible expenses. A concierge can always answer questions about qualified expenses as you plan for any copayments or other fees.

When you use our built-in telemedicine and behavioral health offering, we’ll encourage you to charge any fees to your HSA.

We can help members determine if purchases for items like CPAP machines, wheelchairs, and portable oxygen concentrators are HSA-eligible. Our concierge can even recommend a local provider or provide an approved online vendor.

Near the end of the year, our AI assistant, JOY, will remind you to make use of any eligible financial accounts.

Our goal is to make it easier to be healthy and well. Health financial accounts are an integral part of this strategy, helping you pay for healthcare expenses and save for the future.

When they’re top-of-mind, you remember to contribute regularly, use them when applicable, and make them a part of your regular healthcare decisions.

Using benefits is notoriously difficult. It seems that no matter how much is shared during Open Enrollment, when it comes to actually remembering,...

Employer healthcare costs climb every year. For individuals, the stakes are perhaps even higher.

For an employee, navigating the healthcare system is just a series of difficult decisions. With unclear pricing and confusing deductibles, it’s...