How HealthJoy Helps Members Use Health Financial Accounts

Health financial accounts are an excellent tax-free way to save money on eligible medical, dental, and vision expenses. Health Savings Accounts...

Connected Navigation Platform

Guiding to high-value care

Behavioral Health

Foster a mentally healthy workplace

EAP

Supporting holistic wellbeing

Virtual MSK Care

Reimagining musculoskeletal care

Virtual Primary Care

Powered by smart navigation

Surgery Centers of Excellence

Best-in-class surgical outcomes

Virtual Urgent Care

Immediate care, any hour of the day

Chronic Care

A new approach to chronic care

Integrations

Flexible to any strategy

As healthcare costs continue to skyrocket, it’s more important than ever that employers offer a wide variety of solutions that are easily accessible. For employers, offering a Health Savings Account (HSA) is an effective and approachable way to help their people consistently set aside money to pay for qualified medical expenses.

To help counter escalating costs, health insurance companies created high-quality plan options at affordable prices - a process that changed the health insurance marketplace considerably.

Although we’ve seen the emergence of PPOs, HMOs and other options meant to steer consumers to certain providers at lower claims costs, there was a point in time where major savings for these plans flatlined. To keep health care affordable, companies have shifted out-of-pocket risks to consumers. In this post, we'll examine the history of HSAs, how they work, contribution limits and much more!

HSAs debuted in 2003 as a way to support individuals on High Deductible Health Plans (HDHPs). The concept was simple: as a medical savings account, an HSA allows consumers to put money into the account on a pre-tax basis to use at a later date for expenses that aren’t covered by their health insurance. Another benefit of HSAs is that contributions are tax-free as long as they’re used for qualified medical expenses.

Employees own the HSA and all the funds in it. The account belongs to the employee even after they’ve left the company, regardless of whether they’ve been terminated, retired or switched jobs.

For those who don’t expect to incur many medical expenses, HSAs act as an investment vehicle for the future. Employees can even use funds contributed in their 20s to pay for medical expenses after retirement. This can provide a great sense of financial security for those with an HSA.

Additionally, there are no “use-it-or-lose-it” policies when dealing with an HSA. When someone retires, they can even use the funds for non-medical expenses without penalty. However, to keep making contributions to an existing HSA, they’ll need an HSA-eligible health plan.

If an employee switches jobs and wants to transfer their funds over to their new employer’s HSA to take advantage of pretax contributions, they can simply roll over the funds to the new HSA provider and close the old account. There aren’t any rules about holding multiple HSAs, but if healthcare consumers choose to keep the old account and open a new one, it’s important to note that the annual contribution limit applies to all of their HSAs combined.

It’s key to note that not everyone enrolled in an HDHP is eligible to enroll in an HSA. Since there are tax benefits for HSAs, there are specific rules in place.

To be eligible for an HSA employees should be:

If employees can afford to contribute the maximum to their HSA each year, it can be a smart investment in their future. Unlike a 401(k), an HSA lets employees save for future medical expenses without paying taxes or penalties when they withdraw the money.

If employees closer to retirement age feel like they may be behind, you can let them know that HSAs offer options to catch up! HSA account holders aged 55 or older are eligible to employ an additional HSA contribution catch-up contribution limit of $1,000 beyond the standard annual maximum.

In 2024, individuals can contribute $4,150 and families can contribute $8,300 to a tax-free HSA.

Employees should consult with a tax professional before making any contributions.

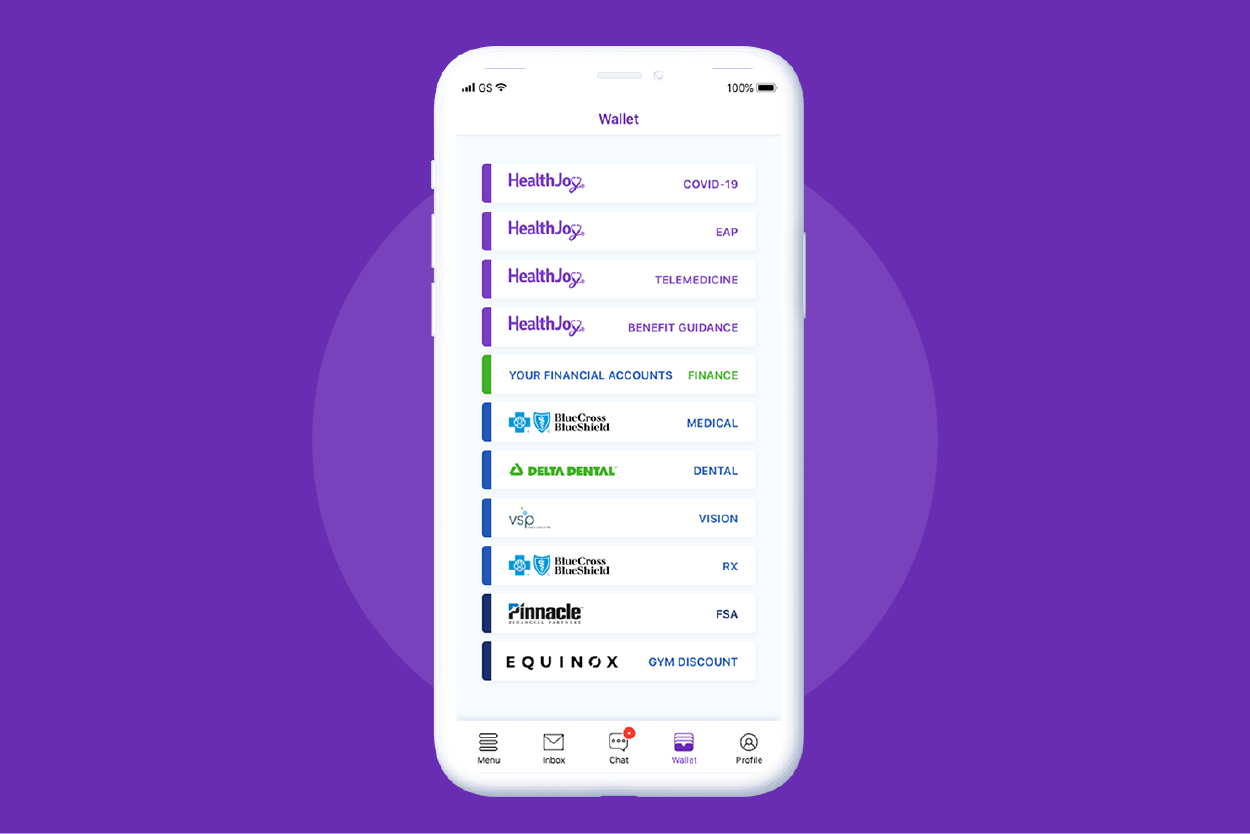

When you integrate your employees’ health accounts into HealthJoy’s platform, we can help turn understanding into action.

Virtual Urgent Care

When employees use HealthJoy’s Virtual Urgent Care and Behavioral Health solutions, we’ll encourage them to charge any fees to their HSA.

Reliable, affordable medical equipment

We can help determine if purchases like CPAP machines, wheelchairs and portable oxygen concentrators are HSA-eligible. Our concierge can even recommend a local provider or provide an approved online vendor.

Our healthcare concierge team can help with questions about what’s covered, contribution limits and much more.

For employers looking for ways to help employees save money to cover future expenses, an HSA can be the perfect option for retaining and recruiting employees.

HSAs can be a valuable financial tool for employees looking to supplement their HDHP coverage and ensure that they have the funds set aside to pay their future out-of-pocket expenses.

Register for our upcoming product demo webinar to experience HealthJoy via a full demo of the app and get the opportunity to ask any questions during an interactive Q&A session.

This post was previously published in 2022 and updated in 2024.

Health financial accounts are an excellent tax-free way to save money on eligible medical, dental, and vision expenses. Health Savings Accounts...

Using benefits is notoriously difficult. It seems that no matter how much is shared during Open Enrollment, when it comes to actually remembering,...

Every day we talk to hundreds of members about a wide variety of issues. One of the issues we constantly help with is medication. Prescription...