How a Care Navigation Platform Streamlines Open Enrollment

Open enrollment season is a marathon for HR and benefits professionals. It takes a lot of planning, communication and action to be successful. At...

Connected Navigation Platform

Guiding to high-value care

Behavioral Health

Foster a mentally healthy workplace

EAP

Supporting holistic wellbeing

Virtual MSK Care

Reimagining musculoskeletal care

Virtual Primary Care

Powered by smart navigation

Surgery Centers of Excellence

Best-in-class surgical outcomes

Virtual Urgent Care

Immediate care, any hour of the day

Chronic Care

A new approach to chronic care

Integrations

Flexible to any strategy

With open enrollment winding down and new benefits rolling out to employees, your HR department is far from taking its foot off the gas. In fact, it’s likely you’ve just shifted your energy to making sure employees actually use all those great benefits, and you have good reason.

Engagement drives up benefits satisfaction and keeps your employees happy. That means utilization rates touch everything from your recruiting and retention efforts to total healthcare costs for your employer. In other words, these efforts are well worth your time and energy.

In this post, we’ll address one of our best strategies for increasing utilization: driving family benefits engagement with a complete benefits package.

Over the last few months, you nailed your employee benefits presentation, ditched your benefits booklet, and worked hard to establish trust in your newest benefits.

But no matter how robust your employee benefits communication strategy was during open enrollment, you may struggle with engagement after launch. That’s because communication during open enrollment alone isn’t enough for employees.

The same is true of communications with family members on your company’s benefits. To achieve the engagement and utilization you need for real employee satisfaction, you’ll need to reach them, too.

According to the U.S. Department of Labor, women make 80 percent of health care decisions in the United States. That’s helpful when women are also the primary insured employee. But when they aren’t, it means that much of the information you’re passing to employees during open enrollment passes through a filter before going to the decision-maker.

Let’s say one parent is traveling and another is home with a sick child. The traveling parent may be the employee. If they’re the only one who attended a lunch and learn about telemedicine, their partner may not know that it’s an option. They may stick with an expensive ER visit instead.

A more commonplace example: one partner usually takes care of medical bills. They aren’t your employee, so they missed your employee communications about your bill review benefit. Instead, they elect to just pay an expensive bill as part of their monthly workflow. A bill review may have saved them hundreds (or even thousands) of dollars. Since both partners weren’t aware of the service, you’ll never know.

Finally, let’s say an adult child lives out-of-state and makes healthcare decisions on their own, with little to no guidance as to what is included in a health insurance plan. Their bills are passed to their parents and your employer. With no education, they keep choosing the most convenient—and most expensive—care providers.

None of these scenarios require a stretch of the imagination. They might even be the status quo. And they demonstrate why there’s value in making spouse and dependent education a part of your year-round benefits communication strategy.

Do all you can to collect contact information for eligible spouses and dependents during enrollment. At HealthJoy, we strive to collect contact information including phone numbers and email addresses for every adult in the family during our setup process (HealthJoy is free for family members.)

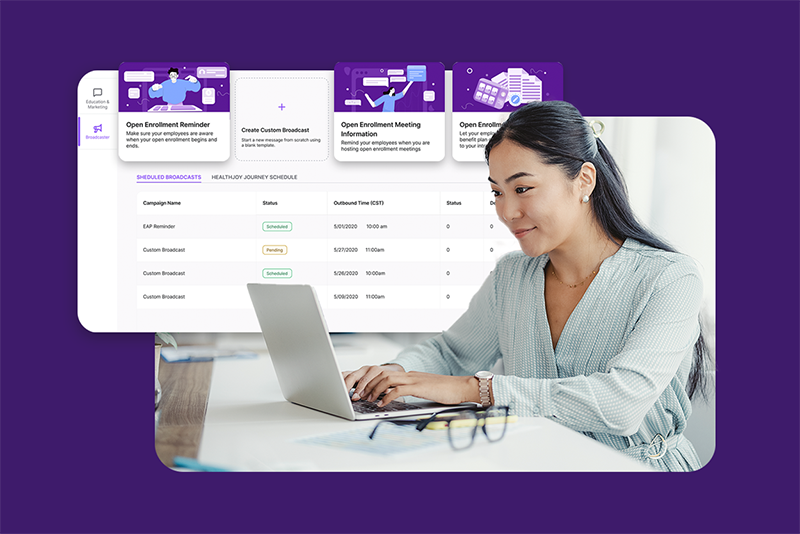

Collecting this information is a key first step because it allows you to loop the whole family into your year-round email campaigns. If you’re able to collect mobile contact info, you can even use an SMS campaign to prompt them to take part in different benefit programs(see The Best Benefits Engagement Tool You Haven’t Used for more).

In other words, collecting contact information is the easiest way to ensure your family-wide education efforts succeed.

Though we talk a lot about the importance of using all the tech at our fingertips, from Slack reminders to AI, there are times when you simply can’t beat an old-fashioned mailer. Since some contact info is sure to slip through the cracks, mailers can be a good way to contact those difficult-to-find decision-makers.

I’ll give you an example: last month, I told my husband that he’ll have a new pre-tax transit benefit available through his employer in 2020. He had no idea. Work’s been hectic, and he missed the office communication. I’d read through the mailer sent to our house, and I was happy to fill him in 🙂

When benefits are centralized in a website or, even better, in an app, it’s easier for employees and their families to directly access all their benefits. Websites are easily created, but they tend to have lower engagement. Apps, with their ability to deliver two-way communication, are a superior solution. Giving your employees and their families a single place to go for all their benefits is a great way to get them to engage with an entire benefits package.

Engaging family members is key to helping employees make the most of their benefits beyond open enrollment. When you include the whole family in your communication efforts, you’ll ensure every family member has the tools they need to make smarter healthcare decisions. The result—not just higher employee satisfaction but healthier, happier families—is well worth the extra effort beyond OE.

Open enrollment season is a marathon for HR and benefits professionals. It takes a lot of planning, communication and action to be successful. At...

3 min read

As you consider how best to engage employees this open enrollment season, may we suggest you ditch the benefits booklet? Burn it.Flush it.Use it...

Benefits communication is notoriously tricky. Lunch and learns? Employees resent taking time out of a busy day. Long emails? They’re all too easy to...