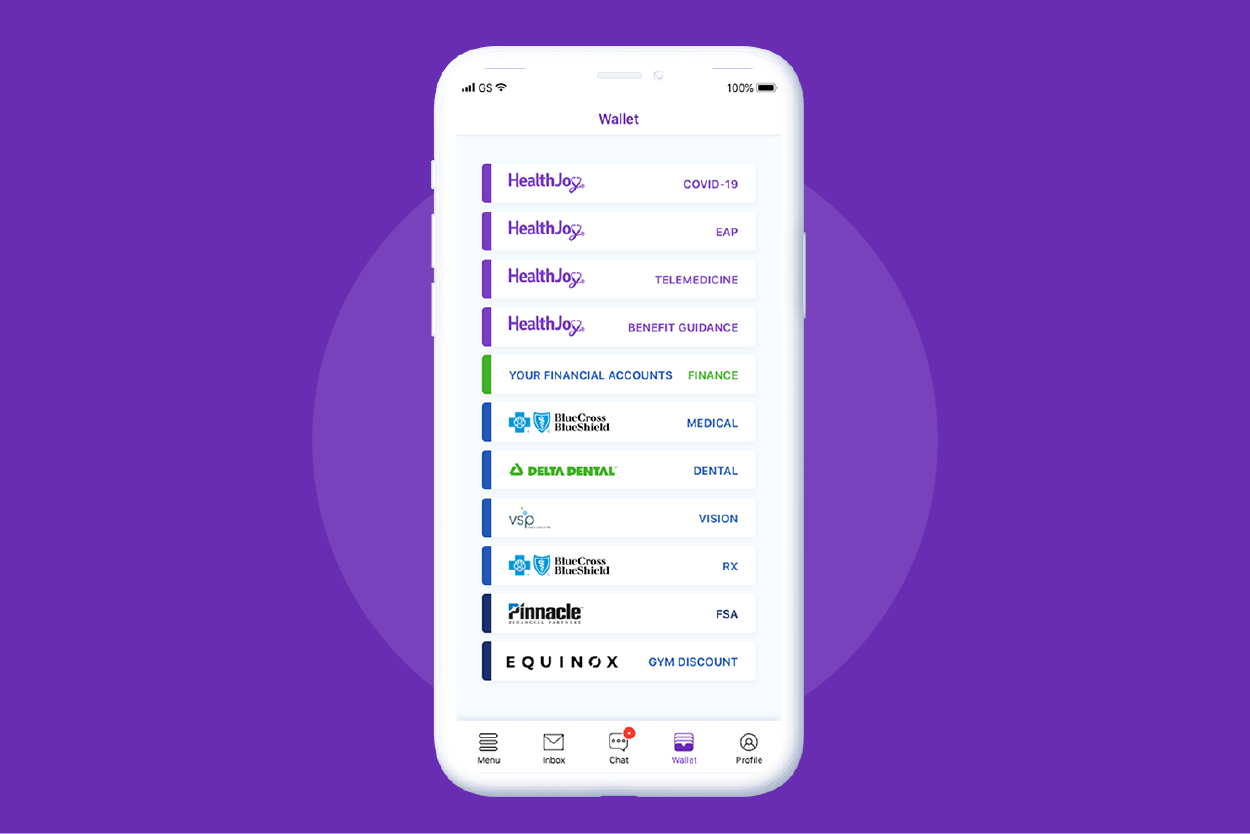

How the HealthJoy Benefits Wallet Works

Using benefits is notoriously difficult. It seems that no matter how much is shared during Open Enrollment, when it comes to actually remembering,...

Connected Navigation Platform

Guiding to high-value care

Behavioral Health

Foster a mentally healthy workplace

EAP

Supporting holistic wellbeing

Virtual MSK Care

Reimagining musculoskeletal care

Virtual Primary Care

Powered by smart navigation

Surgery Centers of Excellence

Best-in-class surgical outcomes

Virtual Urgent Care

Immediate care, any hour of the day

Chronic Care

A new approach to chronic care

Integrations

Flexible to any strategy

4 min read

Rick Ramos

:

August 23, 2017

Rick Ramos

:

August 23, 2017

Benefits specialist Matt White has embraced his role as a “Millennial” benefits advisor. After hearing countless CFO’s repeat the defeatist mantra of “Rates go up, there’s nothing a company can do,” Matt went on a mission to bring new strategies to break that trend.

Recently hired by the Maryland-based agency Employee Benefits Group to spearhead their implementation of innovative strategies, the move has been a resounding success for both clients and agency growth. We sat down with Matt to learn more about the role of the young innovator in employee benefits.

Brian Astrachan: You have led the charge bringing in innovative solutions for your clients. What motivates you to stay on the cutting edge of client strategies?

First, my wife is an HR Director at a local government contractor. I’ve seen firsthand the tremendous asset a benefit partner can be to HR professionals, the company bottom line, and also client employees when there is a strong partnership in place.

Second, prior to coming onboard with the Employee Benefits Group, I worked with a number of benefit brokers. I was inspired by a few that were seeking innovative ways to deliver advantages through employee benefits. It was awesome to watch the passion, the impact, and the strong partnership these advisors shared with their clients. Alternatively—and I get passionate about this— I saw a number of advisors who operated under what I call the “trust me, I’ve been doing this a long time” mentality. Look around, the world is changing. I’ve said harshly to others that this is similar to doctors I met while working in the pharmaceutical industry who were still prescribing Ibuprofen the same as they had since the 70’s for virtually everything.

Ultimately, brokers have a tremendous opportunity to help out those in our communities. Healthcare is in flux right now, and a few are getting very rich at the expense of many – pay raises are often less than benefit cost increases. $1 Million spent in 2007 has become $2.4 Million in 2017 based on a PwC study reporting annual health insurance cost increases. Cost increases are becoming unbearable, and I believe we’re at a boiling point. Those willing to acknowledge the challenge— and help clients stray from pessimist nonsense ‘that’s just the way it is’ thinking—will be rewarded.

Tell me about some of the strategies you are most excited about bringing to clients, especially for clients that are self-funded.

Lately, I’ve been excited about working with clients to provide an empowered employee position. Here’s what I mean by that and how it benefits everyone: Employees often don’t understand their health benefits. It’s a line item deduction on their paystub. This is how I personally existed for much of my professional career. Health insurance can be monstrously complex, but my goal is to deliver it to employees in the palm of a hand, thanks to smartphones. HealthJoy helps with that tremendously, shout out to “JOY”.

I also like the idea of consumerizing healthcare for employees. Yeah, I made up the word “consumerizing,” but bear with me on this. Gone are the days where an employee can pay premiums, show up at a doctor’s office, hand over their medical card, and leave. That ‘easy button’ approach got expensive fast. Employees are now sharing more of the cost of their own healthcare than ever before, and it makes sense for them to ‘shop’ around to find the best value service. Something as simple as a blood panel can cost between $20 or $400…for the same exact blood panel. Traditionally we’ve found out the price only when it is sent by mail to us in the form of a bill. It’s an absurd way to do business that is, for some reason, acceptable in the medical community. That absurdity has no place in healthcare anymore.

I think a lot of brokers are doing well to add benefit administration technology offerings for clients since there’s still paper enrollments that exist. That said, I don’t count these tools as differentiating ones. They’re all virtually the same: open enrollment, carrier connections, reporting, and hopefully integration to payroll. Throw in a smartphone app and maybe a pretty user interface, and I’ve just described 90% of benefits administration platforms out there. That’s table stakes.

You have brought on a lot of new groups since the start of the year. How have you been able to effectively communicate new ideas that employers had never heard of?

References are huge. When you’re asking someone to take a risk and do something different than what they’ve been shown in the past —and our proposals are different—I’d suggest a proof of concept. I reference a number of other case studies with real results and outcomes we’ve been able to create for other groups. I demand it from my technology partners as well. I’ve seen good boardroom ideas blow up when it came time to make rubber meet the road.

It’s fun to think creatively when working with amazing clients. We all have to start combating rising healthcare costs. I jokingly said to one client that they should buy stock in the carrier they were being fully-insured by to subsidize the cost of the insurance—his carrier had hit its quarterly goals in 27 out of the past 28 quarters. We joked considering that there was less risk in their stock performance than there was in his plan. In a later conversation, he admitted that he had actually looked into it, and had given the idea serious consideration.

Many consultants and agencies still adhere to the status quo. What advice would you give to those who want to adopt new strategies?

Changing and adopting new strategies is not easy but it’s completely worth it. Here’s why:

Through college, I worked at the Olive Garden, and I loved that job. I could probably still sing all the words to “That’s Amore” since it played 83 times per night. If I wasn’t on my server game on a given night and didn’t sing perfectly, the dressing we put on the salads would still provide an enjoyable dining experience. Today, I’ve chosen to work as a benefits broker. If brokers are not on their game on a given day, doing our absolute best for clients and their employees, there are massive consequences to employees’ health and financial well-being. This is a long-winded way of saying you’ve got to care deeply and be passionate about the people you serve. We look at spreadsheets, benefit summaries, and other data-filled grids for much of our day. That data represents human life and large portions of hard working employees’ personal wealth. The status quo isn’t good enough when what’s at stake are health and wealth – it’s just not.

If you care on a deeper level, you’ll seek out ways to help clients. You’ll end up finding other like-minded benefit professionals to speak with and collectively become better (I collaborate with other brokers all the time). If we get this right, we can really help those in our communities. Change and stepping away from the same ol’ status quo may not always be easy, but it’s completely worth it. I have the best job in the world and I refuse to not serve my clients to the best of my ability with the industry’s best ideas and partners.

Using benefits is notoriously difficult. It seems that no matter how much is shared during Open Enrollment, when it comes to actually remembering,...

Dental and vision benefits are in some ways the forgotten pens at the back of our junk drawer. They’re there, and they work, but we often forget to...

As healthcare costs continue to skyrocket, it’s more important than ever that employers offer a wide variety of solutions that are easily accessible....